[ad_1]

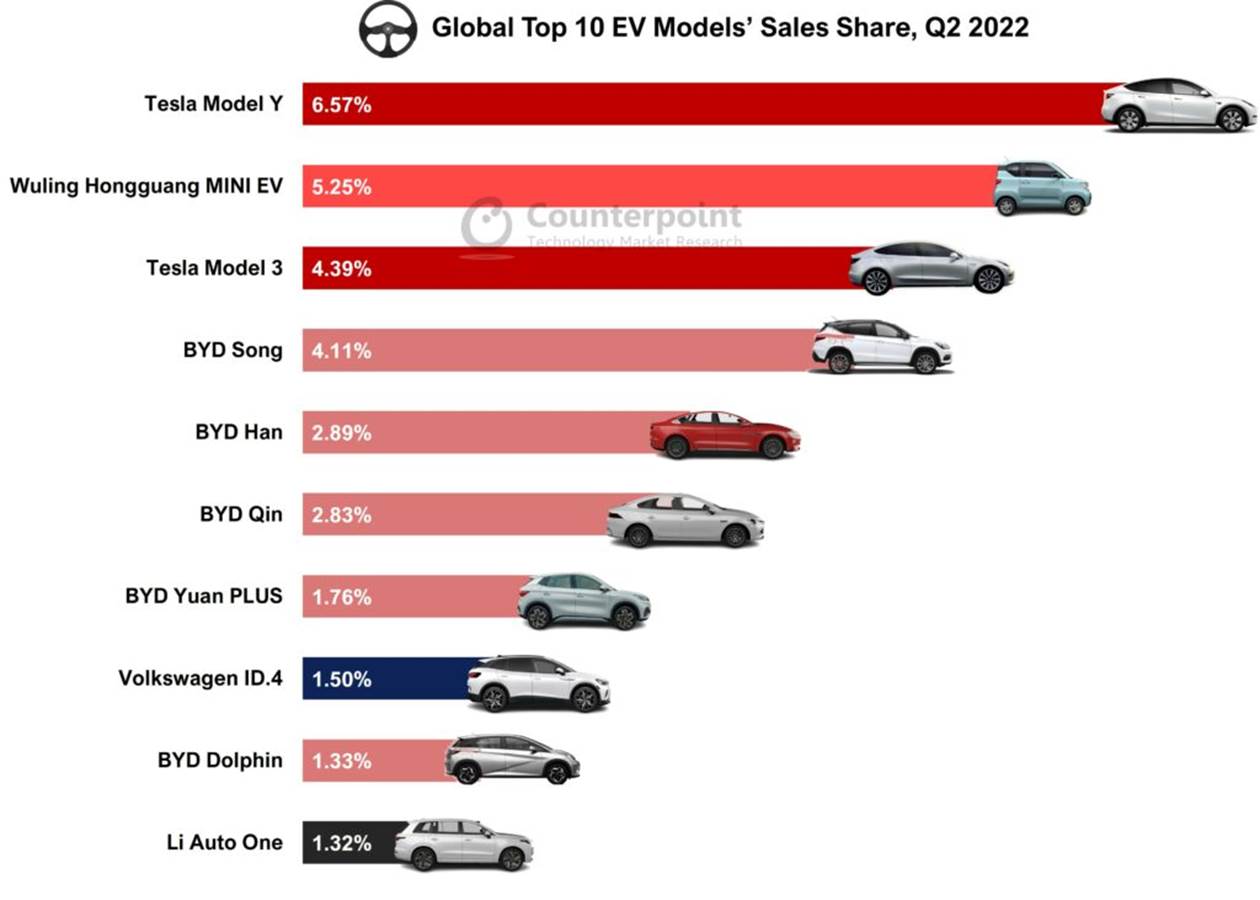

International passenger electrical automobile* (EV) gross sales grew 61% YoY to achieve 2.18 million items in Q2 2022, based on the newest analysis from Counterpoint’s International Passenger Electrical Automobile Mannequin Gross sales Tracker. In whole EV gross sales, battery electrical autos (BEVs) accounted for nearly 72% and plug-in hybrid electrical autos (PHEVs) for the remaining. China remained the market chief in EV gross sales, adopted by Europe and the US. China’s EV gross sales elevated by virtually 92% YoY in Q2 2022 to achieve 1.24 million items from simply 0.64 million items in Q2 2021.

Commenting available on the market dynamics, Senior Analyst Soumen Mandal stated, “As the global semiconductor shortage has eased a bit, automakers are able to cater to the increasing demand for EVs. Moreover, EV sales would have been higher if China had not experienced fresh COVID-19 outbreaks during March. Stringent lockdowns in and around major provinces halted the production ramp-up during April, which resulted in China’s passenger vehicle market recording its biggest drop since the COVID-19-hit March 2020. The situation improved only after lockdowns were lifted during the latter half of May. The second half of 2022 is expected to deliver better results, but economic downturns, energy crisis, supply chain bottlenecks and rising geopolitical tensions may hinder the growth of China’s automotive market, especially EVs.”

Market Abstract

BYD Auto: For the primary time, BYD Auto turned the top-selling EV model, dethroning Tesla. Throughout Q2 2022, BYD Auto shipped greater than 354,000 EV items, a rise of 266% YoY. The corporate formally stopped manufacturing and gross sales of inside combustion engine autos in March 2022 and has been specializing in the event of BEVs and PHEVs. Greater than 60% of BYD’s gross sales in the course of the quarter got here from its prime three fashions – BYD Tune, BYD Han and BYD Qin. The corporate is slowly penetrating the European market. It has already begun operations in Norway and is seeking to begin enterprise in Germany, Sweden and the Netherlands.

Tesla: Tesla’s world gross sales throughout Q2 2022 grew 27% YoY to over 254,000 items, falling wanting expectations. Though enterprise within the US elevated, its China enterprise was affected by COIVD-19 shutdowns. Tesla bought simply 98,000 vehicles in China throughout Q2 2022. Cumulative gross sales in China throughout April and Might fell by 49% YoY. This was the bottom for the automaker because the COVID-19-hit 2020. However its gross sales throughout June improved by virtually 115% YoY. Regardless of COVID-19 clouding Tesla’s Q2 gross sales, it remained the worldwide chief within the BEV phase.

Wuling: The three way partnership between SAIC, GM and Wuling has proved to be a hit because the Wuling Hongguang Mini EV is the best-selling EV mannequin in China. The mannequin has been the undisputed market chief since its launch within the second half of 2020. Throughout Q2 2022, Wuling grew by 16% YoY to carry the third rank within the world EV market.

BMW: BMW’s EV gross sales throughout Q2 2022 elevated by 18% YoY. The corporate has a extra outstanding presence within the PHEV phase. Nonetheless, its BEV gross sales skilled the next QoQ development charge (18%) in Q2 2022 in comparison with its PHEV gross sales (2%). BMW’s goal to have 2 million BEV items on the highway by the top of 2025 is motivating it to make vital developments within the EV class. The BMW X3 and i-series fashions are spearheading the corporate’s push within the BEV phase, whereas the 5-Collection, 3-Collection and X5 fashions are doing the identical within the PHEV phase.

Volkswagen: Volkswagen’s EV gross sales declined 9% YoY in Q2 2022. Its shipments throughout Europe and the US declined by 44% YoY and 74% YoY, respectively. Bottlenecks within the provide of semiconductors and different automotive parts attributable to Russia’s invasion of Ukraine, along with rising inflation, pushed EV gross sales down in these two markets. Nonetheless, gross sales in China grew 115% YoY in Q2 2022. Other than the availability chain disaster, the corporate’s inside points and failure to develop new proprietary software program for its autos are impacting the corporate’s EV cargo targets.

[ad_2]

Supply hyperlink